After great speculation and many daunting media headlines, we finally learned the US tariff plans for Irish products.

On Wednesday April 2nd, a tariff of 20% was announced on US imports from the EU. For now, pharmaceutical products have been excluded, but there remains the worry that targeted tariffs might follow later.

We’ve seen increasing nervousness about the stability of jobs in the Irish pharma industry in the run up to this announcement and while this is initially good news, we might still see that nervousness persist.

Tánaiste Simon Harris, Minister for Foreign Affairs and Trade, was quoted on Thursday morning as saying

“my working assumption has to be that there will be further measures directed at pharma”.

But what would a tariff on pharmaceutical products actually mean for Ireland’s pharma industry and the people working in it, if it were introduced?

My headline takeaway – Irish pharma jobs are safe from Trump’s tariffs for 10 years.

Let’s dig a little deeper into why…

What do Tariffs Mean for Pharma in Ireland?

Ireland’s pharma history with the US

The pharma industry is a huge contributor to Ireland’s economy.

Kate English, Chief Economist with Deloitte Ireland, told RTE that “Medical and pharma products exported to the US accounted for 20% of total good exports in Ireland in 2024, and they accounted for about 61% of your total goods exported to the US”.

In 2024, €58 billion of pharma products were exported to the US.

Historically, pharmaceutical products have been exempt from tariffs thanks to the World Trade Organisation’s 1994 Pharma Agreement which the European Union and the United States both participate in. But after recent comments from both the US President and the Commerce Secretary, there had been growing speculation that the US might choose to target pharmaceutical products made in Ireland with tariffs.

While the media focuses on big trade numbers, what we’re hearing is that people are more concerned about the Irish jobs that are currently supported by this industry.

And that’s not really that surprising.

Pharma Employment in Ireland

In April 2024, the Expert Group on Future Skills Needs estimated that the Biopharma industry in Ireland directly employed around 50,000 people and that a further 40,000 were employed indirectly across the country by companies that support the industry.

American companies such as Pfizer, Eli Lilly and Johnson & Johnson are some of the biggest employers in the sector in Ireland.

The chief executive of the Irish Pharmaceutical Healthcare Association, Oliver O’Connor, recently estimated that approximately 30,000 of those directly employed in the industry were working for American companies.

That’s a lot of people wondering about the security of their role.

So after this new announcement and some ongoing uncertainty, why am I still saying Irish pharma jobs are safe?

Irish Pharma Jobs are Safe for 10 Years

I think that a lot of commentary on this issue has been missing one very important thing…

Pharma companies don’t operate on short term moves.

They plan in the medium and long term.

And they use that time scale because they have to.

Everyone knows that medicines take years to get to market. From initial R&D through to manufacture of a saleable product takes over a decade.

What’s much less widely understood is the process involved in setting up a pharmaceutical plant.

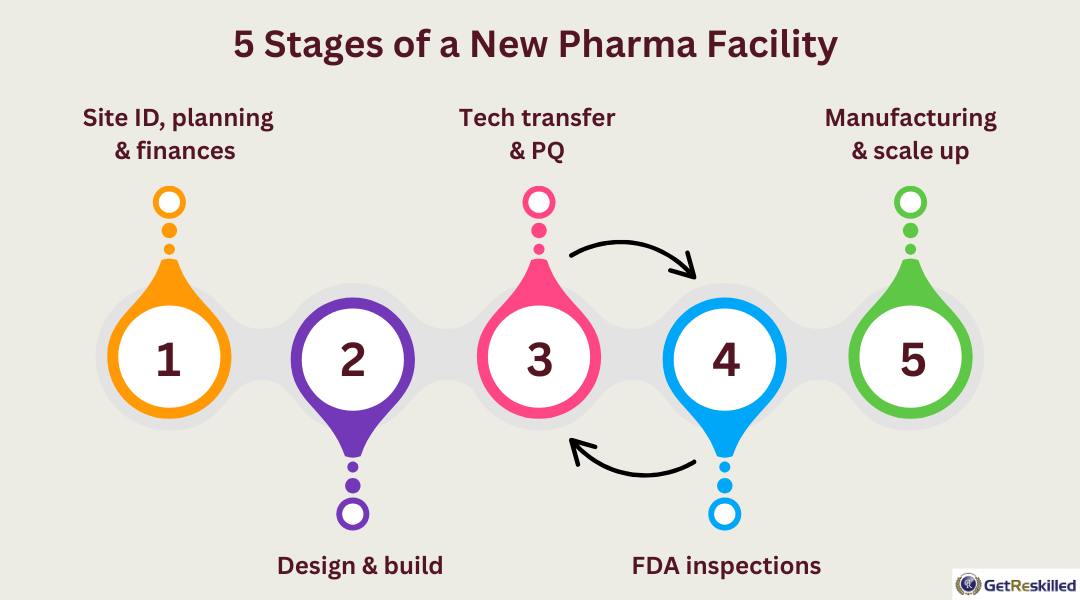

If you’re starting from scratch (which is most often the case) there are 5 key stages to the project:

- Site identification, planning permission, company financial approval (1–2 years)

- Companies are finding a suitable location and applying for planning permission

- There’s also an internal process of securing financial approval for the investment from within the company

- Design & build of manufacturing facility (2–3 years)

- The company will move through all phases of building the manufacturing facility. While we might initially think of activities like construction of the actual buildings, this also includes tasks such as purchasing complex or highly specialised manufacturing equipment that often has a long order time.

- Once all these things are in place, the company moves through the initial stages of validation (installation qualification & operational qualification) that are essential for regulatory approval to make medicines.

- Technology transfer & Process qualification (1–2 years)

- Within this stage, the company has to demonstrate the reliability and consistency of the validated process within their new site. Essentially, they have to show that the new site makes medicines that are exactly the same every single time. During this stage, a designated number of consecutive approval batches of product must be manufactured and tested. The duration of this phase depends entirely on the product being manufactured. This is also the time where manufacturing operators will be trained on the manufacturing process.

- The project moves back and forth between this stage and the following stage until all points have been addressed. Tech transfer isn’t over until the site is finally handed to the manufacturing team.

- FDA inspections (1–2 years)

- While applications for regulatory approval for the site begin much earlier in the process, it’s only at this point that the facility can complete the final regulatory approval audit.

- This audit will typically generate a series of areas that require additional testing or updating within the process. For each of these, the company will go back to stage 3 and re-test.

- Only once all of these points have been addressed can a company start selling medicines that are produced in their new site.

- Manufacturing and scale up (up to 3 years to fully replace a well established manufacturing site)

- For a manufacturing site to replace another takes time. A company will typically aim to use the new site to make:

- 25% of the product by the end of year 1

- 50% of the product by the end of year 2

- 100% of the product by the end of year 3

- During this time, the original site still needs to be operational to continue to meet the demand for the product.

- For a manufacturing site to replace another takes time. A company will typically aim to use the new site to make:

On top of all of that, there are other significant challenges to opening a new site, such as finding the required numbers of appropriately skilled staff. Large pharma manufacturing sites employ hundreds (sometimes thousands) of people.

All that is to say, setting up a new pharma manufacturing site is not a quick process that can be completed at a moment’s notice.

The industry trade group PhRMA was also recently cited as estimating that, “Building a new production facility in the US can cost up to $2 billion and take five to ten years before it is operational, including time and costs related to fulfilling regulatory requirements”.

And when we’re talking about a product that’s already on the market, people still need to be able to buy that product right now. Companies simply cannot shut down fully functioning Irish sites that provide saleable medicines now, when the alternative isn’t going to give them saleable medicines for years to come.

So even if US pharma companies wanted to move significant manufacturing from Ireland to the US in reaction to a tariff, it’s going to take them years to do so. Long beyond the term of any single president.

This sentiment was recently echoed by Oliver O’Connor, the chief executive of the Irish Pharmaceutical Healthcare Association. He was quoted as saying that companies have “invested for the long term” and that decisions to invest had been made many years ago.

And Lilly CEO, David Ricks, confirmed to the BBC that the Irish facility the company is currently building will go ahead as planned.

What Might the Impact be?

That’s not to say that a targeted tariff wouldn’t have any impact on Irish pharma, of course.

We would probably see some hiring freezes within Irish operations in the short term as companies assess the specific impact on their operations. With an estimated replacement demand of 2.4%, companies often look to initially decrease employee numbers by simply not replacing staff as they naturally leave the company.

That would also be a time we might see more shuffling of staff between roles within a company which can work out well if you’ve been upskilling for the next role in your career. But even in a hiring freeze, recruitment doesn’t typically stop altogether and critical/niche roles are often still advertised and filled.

We would potentially also see a decline in future pharma investments in Ireland. That would mean there might not be so many new sites or expansions within current sites as we move forward. As a result, we would potentially see fewer headlines announcing new jobs coming to an area. But again, note that wouldn’t impact current sites or jobs.

After 40 years of industry experience, I just don’t see current Irish pharma jobs disappearing overnight.

Even if there were to be a targeted tariff on Irish pharmaceutical imports into the US.

And to bring ourselves back from that “worst case” example to today – it’s even better news. Despite speculation in the run up, Ireland’s pharma industry has been excluded from the newly announced 20% tariff on EU imports into the US.

Given that there are many other industries where operations can (and might just) be moved to the US at relatively short notice, I think if you’re looking for 10 years of job security in Ireland, pharma is still a great choice.

Pharmaceutical Industry Courses

Interested in a new career in the pharmaceutical or medical device industry? Or are you ready to upskill for a better job or a promotion? Then check out our range of AWARD-WINNING pharmaceutical courses.

About the Author

Gerry Creaner

President

Senior Lecturer with GetReskilled

Gerry Creaner has over 40-years of experience in the Life Sciences Manufacturing industry across a range of technical, managerial and business roles. He established a very successful engineering consultancy prior to founding GetReskilled, an online education and learning business, with offices in Singapore, Ireland and Boston (USA), focussed on the manufacture of safe and effective medicines for the public.

He is also a founding Director of two Singapore based philanthropic organizations, the Farmleigh Fellowship and the Singapore-Ireland Fund, both of which deepen the well established and historical Singapore – Ireland relationship and deliver long-term benefits to both countries.

Gerry has an undergraduate degree in Chemical Engineering (UCD, 1980) and an MSc (Management) from Trinity College Dublin (2003) and is currently doing research for his Ph.D.

Post Your Comments Below