Ireland’s BioPharma-MedTech

Ireland’s BioPharma/MedTech Future Readiness: The resource challenges expected by 2020 and how to overcome them

By: Gerard Creaner

Publication Date: December 2019

Table of Contents (click to the section you would like to read):

Executive Summary

Ireland’s BioPharma/MedTech industry is booming. Using almost any metric, the industry is stronger now than it ever has been. The country is now a manufacturing location of choice for many of the industry’s top companies. But to maintain this position, potential challenges must be identified early and action taken when appropriate.

Having analysed the currently available data for job announcements, industry projections, and statistics on employment and education, it is clear there is a significant potential problem that needs to be addressed.

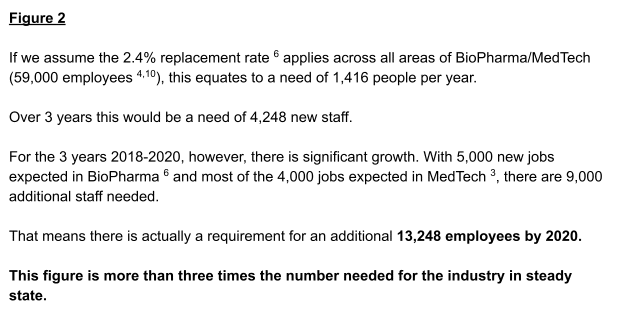

In a steady state, this industry requires approximately 1,416 new employees per year (4,248 over a 3 year period). Looking at the years 2018-2020, a compilation of Government reports and industry job announcements shows that 13,248 new staff are needed. That’s more than three times the figure needed in steady state.

This level of growth is something to be celebrated but it must also be seen as a serious potential problem. The routes by which new employees are currently educated, trained and brought into the industry will only meet the steady state requirements and cannot deliver the required number of people during this boom time.

So this paper will consider the current BioPharma/MedTech industry in Ireland before further analysing the projected BioPharma/MedTech industry needs for 2018-2020. Before finally considering staffing as the solution to current BioPharma/MedTech industry concerns.

The aim of this white paper is to start a conversation among senior industry leaders.

It might not be an easy one, and there might not be clear answers straight away. But it’s a conversation that has to happen soon to protect Ireland’s current standing within this industry worldwide. There are lots of potential solutions to the problem but first, industry needs to engage in an informed conversation.

Ireland has worked hard to place itself as a location of choice for the BioPharma/MedTech manufacturing industry. In this white paper, we’ll consider what it needs to do to remain one.

We’ll further explore the current opportunities and challenges faced by Ireland’s BioPharma/MedTech sector, the current routes by which it’s attracting skilled workers and consider what new alternative routes into the industry might look like.

In Section 1 we’ll consider the current BioPharma/MedTech industry in Ireland.

Government, companies, and academia have worked together to support this growing industry, and they’ve had great success. BioPharma/MedTech companies in Ireland are now employing 59,000 people directly and supporting the employment of many thousands more indirectly. This success has now formed a strong cluster of industry that is, in turn, attracting further investment. Ireland has managed to kick-start a positive feedback loop that is developing an increasingly strong BioPharma/MedTech industry.

In Section 2, we’ll look at BioPharma/MedTech industry needs (2018-2020).

Government and industry body reports have highlighted an upcoming surge of investment and jobs coming to Ireland by 2020. While much of the infrastructure is already in place to support this, one critical part – the market of available workforce talent – is already tightening.

So in Section 3, we’ll consider staffing as the solution to current BioPharma/MedTech industry concerns.

Ireland’s workforce is a key factor for many companies deciding to invest in the country. The current routes by which new candidates enter the industry workforce have, so far, been well-placed to meet the steadily increasing demand. But this predicted surge of investment and jobs by 2020 will challenge the available workforce talent pool and will stretch training and upskilling needs beyond current capability.

Now is the time to bring together stakeholders to discuss alternative routes into the industry. Working together, we can ensure that Ireland remains at the fore of BioPharma/MedTech manufacturing.

Gerard Creaner

President, GetReskilled

Section 1 – The Current BioPharma/MedTech Industry in Ireland

A Brief History of Ireland’s BioPharma/MedTech industry

The worldwide BioPharma/Medtech industries are showing sustained, ongoing success and revenues are displaying strong growth. In 2001, revenue for the BioPharma industry was US$390.2 billion; in 2016, it had increased to US$1,105.2 billion. In just 15 years, revenue had almost tripled.1

Within that growing market, there are several key manufacturing “hubs” – where a significant number of companies set up manufacturing facilities in the same geographical location. Examples include Singapore, Germany, the Netherlands and several locations across the USA. Ireland has also managed to position itself as one of these key industry hubs.

For Ireland, this positioning was relatively late and it has reached prominence quickly. Over recent years, an increasing number of companies have found their way to the country and activities have diversified as a result.

As the Irish Pharmaceutical Healthcare Association outlines,

“The pharmaceutical industry is relatively new to the Irish economy. Most of the companies operating in this area have only had a presence in Ireland since the 1960s. Originally the industry was largely involved in producing active ingredients in bulk for export to other countries to be processed into finished products (tablets, capsules etc.). Subsequently, plants were set up to produce the finished products here. In recent years a number of companies have also set up research centres and have become involved in joint research projects with Irish universities.” 2

As with any of these manufacturing hubs, there are several factors that have combined to provide Ireland’s BioPharma/MedTech industry growth. Three of the most important are:

- A competitive business environment

- Access to the EU marketplace

- A strong pool of talent 3

Ireland’s Biopharma 2018

The term biopharmaceutical (BioPharma) covers traditional pharmaceutical and biologics activities.

In 2017, IDA Ireland (the “semi-state body” who work to bring Foreign Direct Investment into Ireland) reported that there were:

- 75+ biopharmaceutical companies in Ireland (including all of the world’s top ten)

- Over 30,000 people employed directly by the industry

- 90 biopharmaceutical plants (including 40 that are FDA approved).4

This level of activity means that Ireland is now producing high volumes of a huge range of products – it is now the biggest net exporter of pharmaceuticals in the EU.2 In 2016, Irish exports of medical & pharmaceutical products totalled over €30 billion.5 That figure was just €21.6 billion in 2013.

Part of the current success has been Ireland’s ability to attract a diverse range of companies. Those now operational in Ireland vary greatly in size – from small indigenous companies with low staff numbers to large multinationals with hundreds of employees. Although there are over 75 BioPharma companies operating in Ireland, just 35 of these account for 85% of industry employees.6

Comparing 2016 employment to that of 2011, the number of people working in pharmaceutical manufacturing has increased by a third.7 As well as the 30,000 direct employees, the BioPharma industry also supports the employment of approximately 24,500 people in supporting service companies throughout Ireland.8 This makes the industry a major source of employment in the country.

The increase in jobs over recent years has come as a result of major investment activities by several companies. Total investment in new biopharmaceutical production facilities across Ireland has totalled €10 billion in the last decade alone.9

When analysed more closely, the high-value area of biologics manufacturing is now noted to be the fastest growing sector in Ireland and a major source of that investment. There are currently 18 biologics manufacturing sites across the country (this figure was just two in 2003).4 In 2015, 6,700 people in Ireland were employed specifically within biologics manufacturing – that was approximately 24% of all BioPharma employees.6

It is estimated that the annual net replacement demand within the BioPharma industry is 2.4%. Replacement rate is a measure of the number of jobs created every year as a result of retirement or death, and those leaving on a temporary basis (such as for maternity leave or illness). This number is thought to be higher within traditional pharmaceutical manufacturing compared to biologics manufacturing (since the latter has a lower average employee age).6

That 2.4% replacement rate equates to approximately 670 jobs every year. This could be considered as the number of new staff needed within the industry every year if it remained in a “steady state”. It takes no account of newly created jobs or industry expansion activities.

However, all indicators of growth suggest that Ireland is far from being in a steady state just now – growth is fast and the industry’s need for new staff is far higher.

Ireland’s MedTech 2018

The MedTech industry is even newer within Ireland but these companies have invested over €750 million in the country since 2014.3

IDA Ireland highlights that:

- 13 of the top 15 MedTech companies have a presence in Ireland

- Over 29,000 people are employed in this industry (the highest MedTech employment per capita of any European country)

- Over 300 medtech companies operate in Ireland (this figure was just 50 in 1993) 10

Again, there is a significant variation in the size of these companies. While there has been considerable foreign direct investment, the number of home-grown Irish companies is thought to represent approximately 60% of the medtech market in Ireland. 80% of companies are believed to be small and medium enterprises (SMEs).3

A 2017 sentiment survey of MedTech businesses revealed that two-thirds were expecting to hire new staff.11 It also showed that 80% of MedTech industry leaders thought that the Irish business environment was currently either good or very good.

Section 2 – Ireland’s BioPharma/MedTech Industry Needs (2018 – 2020)

BioPharma Industry Projections

In August 2016, The Expert Group on Future Skills Needs (EGFSN) released a report titled, “Future Skills Needs of the Biopharma Industry in Ireland”.

The EGFSN is a group that “advises the Irish Government on current and future skills needs of the economy and on other labour market issues that impact on Ireland’s enterprise and employment growth. It has a central role in ensuring that labour market needs for skilled workers are anticipated and met.” 6

Their report highlighted an expected 8,400 job openings in Ireland’s BioPharma industry by 2020. 5,000 of these jobs are predicted to be additional roles created due to industry expansion.6

Almost all of those 5,000 new roles are expected to come within biologics manufacturing. This represents a 75% increase in staffing within that sector at the time the report was written. In a further breakdown of these roles, 4,000 of them are anticipated to need individuals with “more specific Biopharma science, technology and engineering skillsets”.

This projection is further supported by approximately €4 billion in capital project announcements from multiple large biopharma companies.6

The most recent announcements include:

Alexion

In May 2015, Alexion announced plans for a €450 million expansion in Co. Dublin. The company is building a new biologics manufacturing facility – its first outside of the USA. This new site is required to produce and distribute the company’s product, Soliris. It is estimated that when complete, the facility will create 200 full-time jobs.12

BMS

BMS announced the construction of its new Co. Dublin biologics manufacturing facility in November 2014. It expects approximately 400 new jobs when the facility is fully operational – expected by 2019. The facility will ultimately be producing several products from the company’s biologics portfolio.13

Janssen Sciences

Janssen Sciences announced a €300 million investment to expand its Co. Cork site, in October 2017. There will be an additional 200 jobs at the site upon completion of the project. When the announcement was made, Remo Colarusso (Vice President, Manufacturing and Technical Operations) said “this expansion will increase Janssen’s global manufacturing capacity of biologic medicines… Our Ringaskiddy site is an important part of Janssen’s global manufacturing network and this expansion will allow us to grow in a location that offers an advanced infrastructure, a high-performance culture and top-level talent.” 14

MSD

At the end of May 2017, MSD announced it was investing €280 million across two of its Irish manufacturing sites. In Co. Carlow – the first stand-alone MSD vaccine and biologics facility outside the US – there are to be 120 new jobs. In the Co. Cork plant that specialises in fermentation, purification, and sterile filling of biotech products, there are to be 210 new jobs.15

Not even a year later, in February 2018, MSD made a further announcement of plans to develop a new biotechnology facility – MSD Biotech in Co. Dublin. Once fully operational, the project will create up to 250 new jobs.16

In a further 2018 announcement, MSD detailed plans to construct a second manufacturing facility within its Carlow site. This expansion will create a new vaccines and biologics manufacturing facility and is expected to create 170 new jobs.17

Shire

Shire announced plans for a new biologics manufacturing campus in April 2016. The US$400 million investment in Co. Meath is expected to be fully operational by mid-2019 and create 400 jobs.18

As well as investment from industry, the Irish Government has also committed €8 billion to fund research in the country.4 A clear sign that there is a strong desire to secure the progression of Ireland’s industry across all areas of the drug development process.

In NIBRT’s 2017 Trends in Biopharma Survey, 81% of survey respondents were optimistic (either highly or moderately) for the future growth of the sector.19 With the current strength of Ireland’s biopharma industry, it’s not difficult to see why.

But that same survey showed that 86% of respondents had already had difficulty filling one or more position. With increasing levels of investment and a growing list of companies expanding their Irish operations, the difficulties in hiring staff are likely to become even more pronounced.

And it’s not just a problem for big companies looking to hire hundreds of staff for new facilities. As these projects come to recruit, they will inevitably put further strain on an already-stretched talent pool. That will impact on recruitment for companies of all sizes.

The Future Skills Needs of the Biopharma Industry in Ireland report made 9 key recommendations: 6

- Develop Communications tools to better promote the sector.

- Maximise use of Springboard+ and Skillnets programmes to upskill jobseekers.

- Improve the alignment of Biopharma education and training programmes. Increase the scale of Graduate Entry Development Programmes.

- Raise awareness of the range of rewarding careers in Biopharma including through increased Industry presence at Career Fairs, and Open Days.

- Engage with the Regional Skills Fora to highlight skills requirements and career opportunities in Biopharma.

- Utilise the Biopharma Skills Forum established by BioPhamaChem Ireland including finalising the Biopharma Skill Forums Action Plan for Skills.

- Increase the provision of work placements on a regional basis. Invest in the continuing professional development of the Workforce.

- Increase awareness of Ireland as a location of choice for workers with Biopharma skills.

- Develop a Biopharma Apprenticeship and Biopharma Career Traineeship.

MedTech Industry Projections

In 2017, the Irish Medtech Association published a report titled “Future Skills Needs Analysis for the Medical Technology Sector in Ireland to 2020”.

In it, they estimate that there will be 4,000 additional jobs in the MedTech industry by 2020. Conor Russell, Chairman of the Irish Medtech Association notes that “While some of these jobs represent the replacement of existing staff, most are newly created positions with expanding companies.” 3

As an example of recent MedTech announcements:

Abbott

Abbott announced an expansion of its Donegal manufacturing facility in July 2018. The plant, which opened in 2006, manufactures Abbott’s blood glucose testing strips. The expansion is expected to lead to 500 new jobs at the site.20

That same report estimates that 55% of these jobs will be within operations, 8% will be within quality and 8% will be within engineering.

Looking more closely at the increase in staffing, it is predicted that total industry operation roles will increase by 18% (2,033 additional employees), engineering roles will increase by 23% (376 additional employees) and quality roles will increase by 17% (287 additional employees).3

Again, as these additional roles reach the recruitment phase, the pool of available talent will be stretched even further.

In the same report, Pauline O’Flanagan (Irish Medtech Association Skillnet Manager) noted that, “According to the OECD, Ireland has a higher than average rate of third level educational attainment, with 52% of 25–34-year-olds holding a degree compared to 42% in the rest of Europe. This has helped us to attract foreign direct investment (FDI) and grow businesses, but to compete, we must build on and develop alternative routes to high-quality medtech careers.” 3

The Irish Medtech Association report had key findings across 7 themes: 3

- Ensuring Ireland’s workforce are equipped for the jobs of the future

- Invest in further education, upskilling, and alternative routes to medtech careers

- Develop competency models for the sector

- Promote medtech careers and improve understanding of the sector

- Make Ireland an employment destination of choice for mobile talent

- Embed entrepreneurial education at second level

- Make Ireland a world leader for addressing the gender imbalance in STEM

BioPharma/MedTech Job Announcements

The sections above highlighted some of the biggest recent investment and job creation announcements, but there have already been many more.

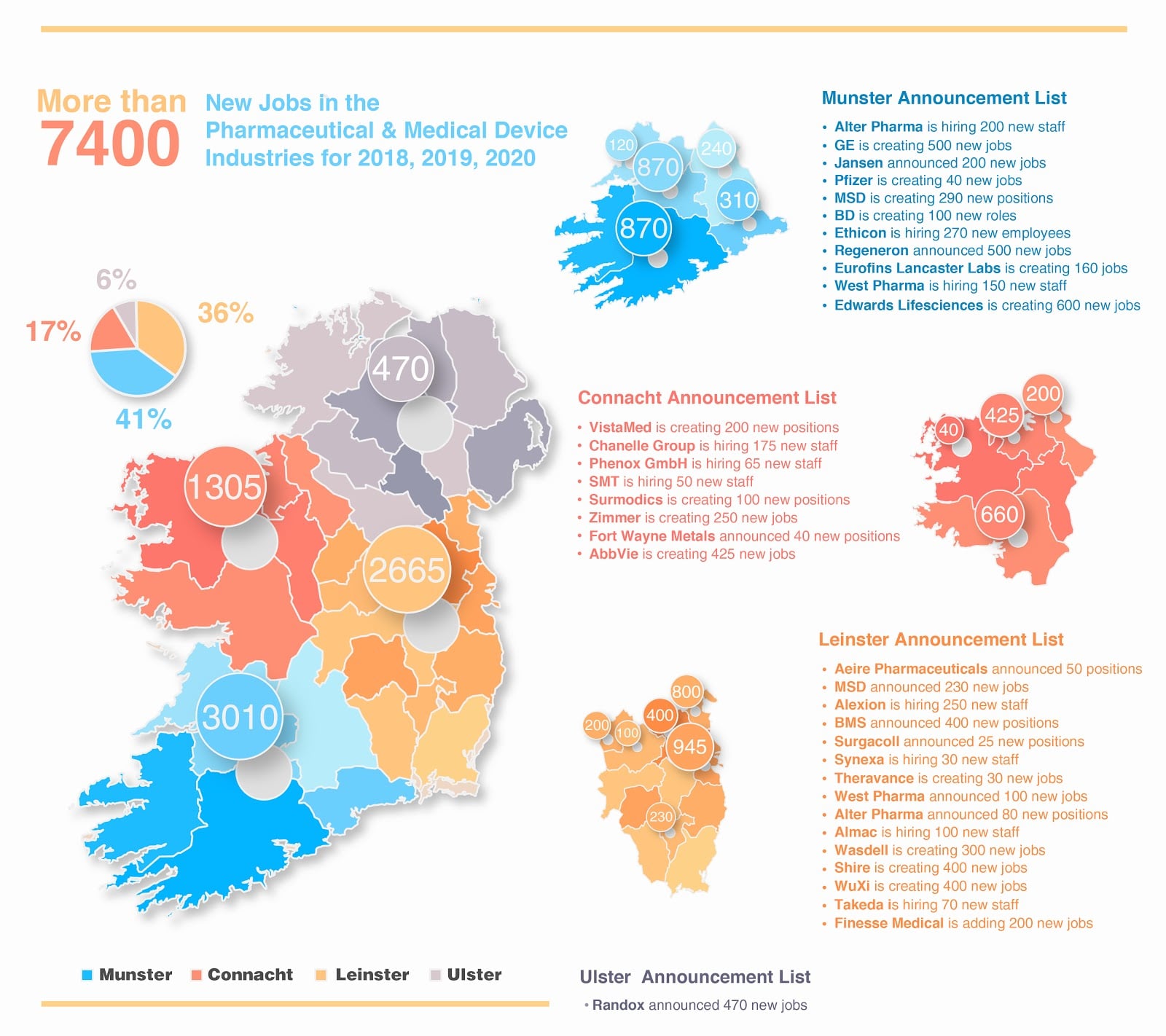

Figure 1 shows new job announcements made by BioPharma/MedTech companies that are, at least in part, still recruiting through the 2018-2020 timeframe. Some of these job announcements originate from before the publications discussed above.

Figure 1 – BioPharma/MedTech Job Announcements Still Recruiting 2018-2020

Great Opportunity… Great Challenges

It is clear that Ireland’s BioPharma/MedTech industry is facing a time of huge opportunity. It is well placed to maximise the strong foundations and reputation that has been built over recent years.

The opportunities that this growth and ongoing investment brings are numerous:

- Employment – one of the most obvious opportunities this level of investment brings to Ireland is jobs.

- Signalling to industry worldwide – multiple significant investments by large companies can act as a signal to other companies that this location is worth investing in.

- Strengthening of the Irish cluster – as companies expand their operations, the range and number of specialist supporting companies who offer services to the industry will increase.

- Specialised workforce – the presence of specialised manufacturing sites means the workforce develops to reflect that need. As it does so, it becomes increasingly attractive to other companies looking to invest.

- Development of local academic institutions – being geographically close to industry can provide academic institutions an opportunity to form close ties and develop working relationships.

- Financial – at a government level, strong industry is needed for a strong economy. At an individual level, jobs in these industries are well-paid.

Many of these opportunities work in a positive feedback mechanism; as a result of the increase in these opportunities, more companies will be attracted, and the level of opportunity will further increase.

Of course, there are also some challenges associated with growth of this scale:

- A stretched talent pool – such a large level of investment over a relatively short time means that there is an increasing pressure on the pool of available talent. Ireland’s employment statistics are better now than they have been for years. In addition, unemployment in the country has fallen significantly over recent years – from 15.1% in 2012 to just 6.1% in 2017.7 This is positive for the population as a whole but can put pressure on employers. Attracting top talent can become more challenging, and more costly.

- Increased competition for the best staff – if the talent pool remains the same size, companies will be forced to offer increasing salaries and benefits to attract the best talent. This, in turn, will increase the overall cost of manufacturing in Ireland.

- A rapidly changing environment – predictions and manufacturing objectives are set well in advance. Some companies may find themselves in the position of trying to fulfil objectives and targets within a market that has changed significantly since those predictions were made.

The EGFSN report noted that there is already a problem sourcing staff with 5 or more years BioPharma industry experience and that job market competition is reportedly already increasing contractor payment rates.6

In MedTech, 90% of Irish Medtech Association Skills Needs Assessment Survey respondents reported that they had found it more difficult to fill vacant positions over the last 5 years. 88% reported that a shortage of skills was having some level of adverse impact on organisation growth.3

Similarly, the SOLAS Vacancy Overview 2016, noted that 31% of all difficult to fill vacancies across the country were in the “Industry” sector. They particularly highlighted engineers, technicians, and operators as roles that were difficult to fill.22

With the investment levels announced in the BioPharma/MedTech industry and the expected numbers of new jobs, the challenges in recruiting for these roles will only become harder if action is not taken soon to extend the available pool of talent.

In alignment with this sentiment, the Strategic Objectives laid out in Ireland’s National Skills Strategy 2025 were: 23

- Education and training providers will place a stronger focus on providing skills

development opportunities that are relevant to the needs of learners, society and the

Economy. - Employers will participate actively in the development of skills and make effective use of

skills in their organisations to improve productivity and competitiveness. - The quality of teaching and learning at all stages of education and training will be

continually enhanced and evaluated. - People across Ireland will engage more in lifelong learning.

- There will be a specific focus on active inclusion to support participation in education and

training and the labour market. - We will support an increase in the supply of skills to the labour market.

Ireland ranked 6th out of 63 countries for competitiveness in the 2017 IMD World Competitiveness Rankings.24 It ranked number one in the categories of labour productivity, investment incentives, national culture, flexibility and adaptability, attracting and retaining talent, and attitudes towards globalization. These are areas where Ireland has successfully gained a positive reputation, now that must be maintained if the country is to remain competitive.

Section 3 – Staffing As The Solution

In the Irish National Skills Bulletin 2017, Richard Bruton (Minister for Education and Skills) said:

“Our aim must be to improve the matching of the skills and needs across the board. We must focus on providing opportunities at all stages in life to all people to improve and expand their skills or change direction in their careers. We must also provide different pathways for people to reach their full potential. Apprenticeships and traineeships can offer exciting opportunities and are a fundamental factor in the success of industry in our European neighbour countries, particularly in Germany.” 7

It is also important to consider the vision laid out in Ireland’s National Skills Strategy 2025… 23

“Ireland will be renowned at home and abroad as a place where the talent of our people thrives through:

- The quality and relevance of our education and training base, which is responsive to the changing and diverse needs of our people, society and the economy

- The strength of relationships and transfer of knowledge between employers, education and training providers, and all sections of society, and the resulting impact on how people are prepared for life and work

- The quality of our workforce – a nation of people armed with relevant knowledge, entrepreneurial agility and analytical skills

- The effective use of skills to support economic and social prosperity, and to enhance the well-being of our country

- The effective use of technology to support talent and skills provision, to grow enterprise and to enhance the lives of all within society.”

Current Routes Into BioPharma/MedTech

Let us first consider the current routes by which new workers are trained and brought into the BioPharma/MedTech industry.

University & College courses

In 2014, 810 graduates from various NFQ levels began employment within the BioPharma industry. (Approximately half had studied science or maths, 24% had studied engineering).6

Individuals entering the industry from this route have qualifications that are academically accredited, often up to degree level. This is seen as the level of qualification required for most roles within MedTech industry (not including operations where only 23% of roles required it).3

While rates of third level graduation were significantly higher in Ireland than the EU average in 2017, just 10.2% of Ireland’s third level graduates were in engineering, manufacturing, and construction. That compares to an EU average of 15% and to the highest rates, from Germany and Portugal, who both had over 20% of graduates in these fields.25

While this route does put new candidates into the pool of available talent, an increase in graduate numbers to meet a growing demand will take 4 years to reach qualification and job-readiness.

In addition, industry is a step removed from this process with no control over the number or type of individuals seeking qualification. With only a small (albeit growing) percentage of candidates gaining industry experience alongside their academic programmes, hiring managers and HR professionals are left recruiting on the basis of academic grades.

Reskilling candidates from other industries

The Irish Government Springboard+ programme was set up to “help unemployed people to remain as close as possible to the labour market by accessing part-time flexible higher education and training opportunities to up-skill or re-skill in areas where sustainable employment opportunities may arise”.26

In 2018, 1,049 Springboard+ BioPharma training places were approved.6

This route also puts new candidates into the BioPharma/MedTech talent pool. Within the current framework, some candidates will qualify and reach job-readiness in a shorter time but with a lower level of qualification when compared to standard university or college courses.

Again though, industry is not in control of the candidates or scale of this program. The number of employees entering the BioPharma/MedTech industries from this route is determined by government funding levels. As reskilling candidates, very few of them are bringing industry-specific work experience.

Upskilling candidates from within BioPharma/MedTech

This is the standard way by which industry employers can meet their own need for higher-skilled employees. Many big BioPharma/MedTech companies have their own programmes in place to upskill talented employees, making them suitable for advanced positions. They can analyse and plan for future demand without the need for outside approval or assistance.

The drawback of this system is that it is not contributing to the overall talent pool available to the BioPharma/MedTech industry. As talented employees are advanced, there is a gap left at entry-level that must be filled.

Apprenticeships

Many industries utilise the apprenticeship model, where an individual completes a combination of on-the-job training and structured education. Lasting between 2 and 4 years, the apprentice remains employed by the approved employer and works towards earning an NFQ award.27

There are some signs of apprenticeship programmes reacting to the specific needs of BioPharma/MedTech with the introduction of two post-2016 apprenticeships that were developed alongside the Irish Medical Device Association. Combined, the manufacturing technician and manufacturing engineering apprenticeships total 135 places so far.28 In addition, BioPharmaChem Ireland has developed a Laboratory Technician apprenticeship programme with 18 places on the first intake.

This route into the industry brings new candidates into the talent pool and offers the unique opportunity for candidates to gain on-the-job training as they study for recognised qualifications. On-the-job training has repeatedly been highlighted as an extremely effective learning strategy.

While industry is much more involved with this process than many of the other routes, the overall number of apprentices is subject to funding and companies themselves have to be approved for participation. This requires a large amount of forward planning and ongoing commitment from industry.

Attracting Irish talent back from abroad & attracting foreign talent

This strategy can bring talent back into the talent pool or bring new talent from alternative locations but it is difficult to do.

Companies themselves have very little say in large-scale initiatives and for any one company to use this method independently would be extremely time and labour intensive.

Table 1 – Comparing the Features of Different Routes by Which Candidates Enter the BioPharma/MedTech industries

| University Courses | College Courses | Reskilling | Upskilling In-house | Apprenticeships | Attracting Irish talent back | |

| Brings new candidates into talent pool | ||||||

| Can react quickly to market conditions | ||||||

| Industry has ultimate control of numbers | ||||||

| Candidates receive academically accredited qualifications | ||||||

| Existing structure in place | (in some companies) |

Your Content Goes The BioPharma/MedTech industry continues to rely on a mix of these current strategies for their staffing. Historically this combination has worked well.

However, the staffing requirements of an industry in steady state and an industry experiencing high growth are very different (see Figure 2).

The current routes into the industry are generally established to serve an industry in steady state. Many of them are not in a position to rapidly increase numbers of candidates available to the industry by 2020.

With an unprecedented number of new jobs coming to the BioPharma/MedTech industry in Ireland over the next 3 years, it is unlikely that these current routes will be able to produce the almost-3-times-more people that will be needed.

A new and innovative solution is needed.

What Would The Ideal Innovative Solution Look Like?

Several BioPharma/MedTech industry professionals might find themselves facing a significant challenge. The parameters on which they have based their staffing predictions and planning have changed. With so many new jobs announced and even more expected, the environment has shifted dramatically. To be able to meet their goals and targets, they will need to look outwith traditional routes into industry.

In their 2017 report, the Irish Medtech Association noted:

“Throughout the stakeholder engagement process, participants highlighted the need for more engagement in work placement, apprenticeship, and co-op programmes. This was considered a key part of the solution to any current and future skills gap. The following figure shows that a total of 12% of respondents do not engage in these programmes but have identified that they would like to be involved.” 3

Having considered the current routes into the industry, where their gaps are, and what others have already recommended, what would a new component look like? What will complement and enhance the industry’s traditional recruitment practices and provide a strong and stable talent pool for the future?

This challenge needs to be considered from three perspectives – employers, government, and individuals.

For employers, this solution would need to:

- Develop a new talent pool – many current hiring practices simply move the same talent pool between companies, driving up salaries and increasing staff turnover. A new solution should look to increase the local talent pool from which employers are hiring.

- Be flexible – the process should be quickly scalable to meet high demand and can be rolled back when employer need is reduced. Companies of all sizes should be able to benefit.

- Utilise best practice – capturing what employers say works best.

- Complement current recruitment activities – companies have systems in place, an innovative solution should try to work with these activities, not against them.

- Bring together academia and industry – close cooperation between these stakeholders is necessary to ensure that employees can get academic accreditation for learning industry-relevant topics, which can form the building blocks for future studies and career development.

- Produce capable candidates – students should learn the skills necessary to match current industry needs.

- Promote employee loyalty – with a growing market, employee retention will continue to be a high priority.

For government, this solution would need to:

- Work to equip people with the skills needed in their local industry – education and skills development should be tailored to the job opportunities that exist.

- Promote a strong industry environment – as that will eventually attract more businesses and opportunities to the area.

- Deliver opportunities to young people – offering the potential of long-term careers in a thriving industry.

For individuals, this solution would need to:

- Offer high job prospects – first and foremost, people want to know they are training in an industry with strong job opportunities and good salaries.

- Provide an entryway to a new career – a big investment in time should be met with opportunities in a new and specialised career field.

- Deliver training that is recognised by industry – all training should be delivered to the highest possible standard and recognised by employers.

- Provide a substantial qualification – more than just being relevant to employers, trainees should be rewarded with a standardised qualification that will be of benefit throughout their career.

- Give guidance on implementing new skills – candidates should not just be left to fend for themselves when trying to secure their first job in a new industry, they should be guided through this process.

Such a solution is not currently one of the standard routes into the industry. Developing it should be a high priority for all involved.

Traineeship programmes, advanced initial training to allow new hires to come directly from a different industry or extended graduate training schemes may be solutions that could be considered. Similarly, the industry might have success considering flexible working arrangements to re-engage older workers in semi-retirement, those who’ve taken career breaks to raise families or those who have additional responsibilities, such as carers.

Importantly, there need to be new ideas that are scalable, quickly. To be successful and meet all current needs, this is something that all relevant stakeholders should be willing to contribute to.

For any new and innovative route into the industry to be successful, companies have to take ownership of their own talent pool and company stakeholders must be willing to try an innovative concept.

They also have to be willing to change company-wide priorities on hiring. It’s not enough to give talent acquisition teams goals based on bringing new hires into the company. It’s also important where those new hires come from, to avoid the same pool of talent simply moving from company to company.

All company stakeholders have to have the same focus and priorities around finding appropriate new local talent with potential. Talent they can develop. Talent they can retain.

Ireland’s BioPharma/MedTech industry can no longer keep relying on what has worked in the past. That appears unlikely to sustain their staffing needs through to 2020. They must look to the future now and take action.

If that doesn’t happen, Ireland will continue to face increasing challenges as demand for staff rises and an already-stretched talent pool reaches a breaking point.

Conclusion

Ireland is currently in a strong and successful position within the BioPharma/MedTech manufacturing industry. It is well-placed to take advantage of company growth and expansion plans, but there needs to be action now to ensure that the talent pool is there to support that.

Current routes into the industry have, until now, provided an adequate staffing level. But with strong growth predicted, those processes will not be enough.

To be truly successful, industry stakeholders have to take ownership of their own talent pipeline. They have to be willing to adopt new concepts, letting them work alongside and compliment their existing recruitment efforts.

As a key factor to Ireland’s previous success, a strong talent pool is in everyone’s best interests. It must continue to grow with demand if Ireland is to remain competitive.

The industry needs to start taking action now. It’s not enough for each company to think that what they’ve done in the past will keep working. Companies of all sizes must start to engage in this conversation and develop new solutions to ensure that Ireland can make the most of this opportunity.

The forums to have these conversations already exist, it’s now up to industry to push this on to the agenda – coming prepared to discuss all possible solutions and bringing all potential stakeholders with them.

References

- Revenue of the worldwide pharmaceutical market from 2001 to 2016 (in billion U.S. dollars), Statista https://www.statista.com/statistics/263102/pharmaceutical-market-worldwide-revenue-since-2001/

- Contribution to the Irish Economy; Irish Pharmaceutical Healthcare Association http://www.ipha.ie/About-the-Industry/Contribution-to-the-Irish-Economy

- Future Skills Needs Analysis for the Medical Technology Sector in Ireland to 2020 (2017), Irish Medtech Association http://www.irishmedtechassoc.ie/IBEC/Press/PressPublicationsdoclib3.nsf/wvIMDANewsByTitle/4,000-jobs-to-be-added-by-2020—irish-medtech-association-04-05-2017/$file/Irish+Medtech+Future+skills+needs+analysis+to+2020+report.pdf

- Biopharmaceutical Industry in Ireland (Autumn 2017); IDA Ireland https://www.idaireland.com/newsroom/publications/biopharmaceutical-industry-in-ireland

- Goods Exports and Imports December 2016; Central Statistics Office http://www.cso.ie/en/releasesandpublications/er/gei/goodsexportsandimportsdecember2016/

- Future Skills Needs of the Biopharma Industry in Ireland (2016); Expert Group on Future Skills Needs http://www.skillsireland.ie/Publications/2016/Biopharma-Skills-Report-FINAL-WEB-VERSION.pdf

- National Skills Bulletin 2017; Skills and Labour Market Research Unit (SLMRU) in SOLAS http://www.solas.ie/SolasPdfLibrary/NSB.pdf

- Key Facts; Irish Pharmaceutical Healthcare Association http://www.ipha.ie/About-the-Industry/Key-Facts

- Biopharmaceutical Manufacturing; IDA Ireland https://www.idaireland.com/newsroom/publications/ida_biopharma_manufacturing

- Medical Technology in Ireland; IDA Ireland https://www.idaireland.com/newsroom/publications/medical-technology-industry-in-ireland

- 11th Irish Medtech Awards Launched (2017); Irish Medtech Association http://irishmedicaldevicesassociation.newsweaver.com/IMDANewsletter/9yvmmqnao4a?a=2&p=52232889&t=29207093

- IDA Press Release – Alexion (May 2015) https://www.idaireland.com/newsroom/alexion-pharmaceuticals-a

- BMS Press Release (Nov 2014) https://news.bms.com/press-release/financial-news/bristol-myers-squibb-construct-new-large-scale-biologics-manufacturing-

- IDA Press Release – Janssen Sciences (October 2017) https://www.idaireland.com/newsroom/janssen-sciences-ireland-announces-expansion-to-in

- IDA Press Release – MSD (May 2017) https://www.idaireland.com/newsroom/msd-ireland-announces-330

- IDA Press Release – MSD (February 2018) https://www.idaireland.com/newsroom/minister-heather-humphreys-td-and-ida-ireland-welc

- IDA Press Release – MSD (October 2018) https://www.idaireland.com/newsroom/msd-to-construct-a-second-manufacturing-facility-a

- IDA Press Release – Shire (April 2016) https://www.idaireland.com/newsroom/shire-to-expand-biotechno

- 2017 Trends in Biopharma Survey, NIBRT https://www.nibrt.ie/wp-content/uploads/2018/03/NIBRTAnnualReport2017.pdf

- IDA Press Release – Abbott (July 2018) https://www.idaireland.com/newsroom/ida-ireland-welcomes-today%E2%80%99s-statement-from-abbott

- GetReskilled, data on file (2018

- Vacancy Overview 2016, SOLAS (2017) http://www.solas.ie/SolasPdfLibrary/Vacancy%20Overview_May17_Web%20edited%20(3).pdf

- Ireland’s National Skills Strategy 2025 https://www.education.ie/en/Publications/Policy-Reports/pub_national_skills_strategy_2025.pdf

- IMD World Competitiveness Online (2017) https://worldcompetitiveness.imd.org/countryprofile/IE/wcy

- Monitoring Ireland’s Skills Supply (2017); Skills and Labour Market Research Unit (SLMRU) in SOLAS

- Developing Talent, Changing Lives. An Evaluation of Springboard+ 2011-2016 http://springboardcourses.ie/pdfs/An-Evaluation-of-Springboard+-2011-16.pdf

- About Apprenticeships http://www.apprenticeship.ie/en/about/Pages/About.aspx

- List of apprenticeships (March 2018)

Further Reading

This work is part of a series of papers.

You might also be interested in: