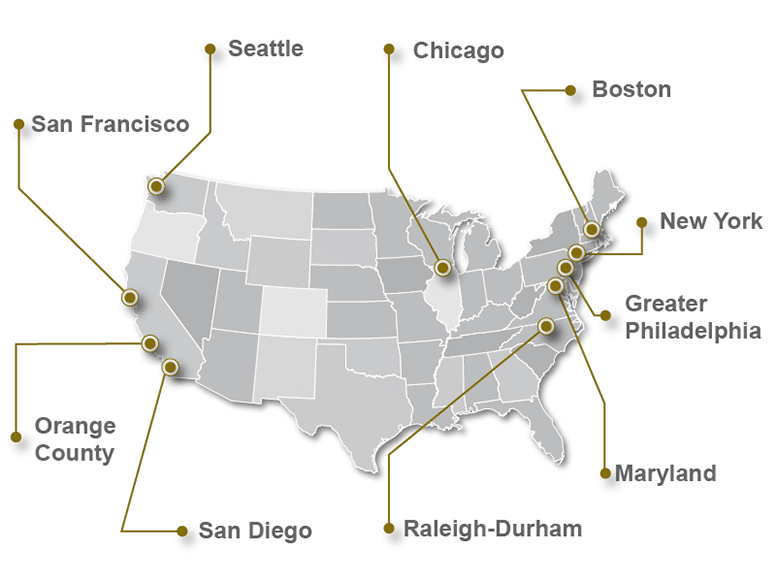

Top 10 Pharmaceutical & Medical Device Industry Hubs in the USA

Let’s take a closer look at the 10 biggest pharmaceutical and medical device industry hubs in the US and where it would be the easiest for you to find a job.

If you live within a commutable distance of one of these hubs then focusing on a career within these industries is a great idea.

Alternatively, if you think this is the career for you and are flexible about your location, should concentrate your job hunt in these areas.

BTW, if you are interested in a career in the Pharmaceutical or Medtech industries or are considering upskilling for a better job or a promotion, check out our range of pharmaceutical courses.

So let’s begin.

10. Chicago, IL

- Jobs: 52,668

- Industry Overview:

- 9.0% growth in biopharma manufacturing jobs (2014-2016)

- Home to the second largest pharma hub in the US

- Companies include - Abbott, Baxter, Sigma-Aldrich, Takeda

- Lab Space (in square feet): 8.8m

- NIH Funding 2018/19: $688.2m

- Venture Capital Funding 2018/19: $332m

- Patents Awarded (total since 1976): 1,246

9. Seattle, WA

- Jobs: 36,102

- Industry Overview:

- 55 pharmaceutical & biotechnology companies

- Fastest-growing life science sector 2014-17 with 17% growth

- Companies include – BMS, Novo Nordisk, Seattle Genetics, Juno Therapeutics

- Lab Space (in square feet): 10.0m

- NIH Funding 2018/19: $843m

- Venture Capital Funding 2018/19: $372m

- Patents Awarded (total since 1976): 2,087

8. Raleigh-Durham, NC (incl. Research Triangle Park)

- Jobs: 36,102

- Industry Overview:

- Biopharmaceutical cluster

- 600+ pharmaceutical & biotechnology companies across NC

- 36% growth in NC biotech jobs since 2001

- Companies include – Merck, Novartis, Pfizer, Eli Lilly

- Ranked Number 1 in Pharma manufacuturing in the US by total employment

- Lab Space (in square feet): 12.4m

- NIH Funding 2018/19: $1.027b

- Venture Capital Funding 2018/19: $480m

- Patents Awarded (total since 1976): 1,124

7. LA/Orange County, CA

- Jobs: 122,012

- Industry Overview:

- 1,500+ pharmaceutical & biotechnology companies, many are R&D stage start-ups

- 11.2% growth in CA biopharma jobs (2013-2017)

- Average OC life science wage $91,523

- Average CA biomedical industry wage $119,070

- Companies include - Amgen, Astellas

- Lab Space (in square feet): 7.9m

- NIH Funding 2018/19: $853.1m

- Patents Awarded (total since 1976): 1,612

6. Greater Philadelphia, PA

- Jobs: 56,452

- Industry Overview:

- 800+ life science companies

- 16 leading pharmaceutical companies (10 are company headquarters)

- Companies include – Teva, GSK, Merck, AstraZeneca

- Lab Space (in square feet): 12.8m

- NIH Funding 2018/19: $886m

- Venture Capital Funding 2018/19: $772m

- Patents Awarded (total since 1976): 1,798

5. San Diego, CA

- Jobs: 66,567

- Industry Overview:

- Medical device cluster

- 1,100+ life science companies

- 11.2% growth in CA biopharma jobs (2013-2017)

- Average CA biomedical industry wage $119,070

- Companies include – Illumina, Genentech, Takeda, ThermoFisher, Pfizer

- Lab Space (in square feet): 18.0m

- NIH Funding 2018/19: $823m

- Venture Capital Funding 2018/19: $1.09b

- Patents Awarded (total since 1976): 4,911

4. Maryland / Virginia / DC Metro

- Jobs: 41,322

- Industry Overview:

- Biotechnology and vaccine cluster

- Area is also home to the NIH & the FDA

- Centrally located – 70% of US pharma industry is within a 2-hour drive

- Enroute to become a Top 3 BioHealth Hub by 2023

- Rated #1 in the US for science and engineering talent

- Lab Space (in square feet): 22.5m

- NIH Funding 2018/19: $1.45b

- Venture Capital Funding 2018/19: $944m

- Patents Awarded (total since 1976): 4,943

3. New York – New Jersey

- Jobs: 130,393

- Industry Overview:

- 3,200+ life science companies

- 13 of top 20 biopharmaceutical companies have headquarters or major facility here

- Lab space set to double in next three years

- Companies include – Regeneron, Johnson & Johnson, Novartis, Merck

- Lab Space (in square feet): 22.6m

- NIH Funding 2018/19: $2.06b

- Venture Capital Funding 2018/19: $1.07b

- Patents Awarded (total since 1976): 3,208

2. San Francisco Bay Area, CA

- Jobs: 74,046

- Industry Overview:

- Biotechnology cluster

- Average CA biomedical industry wage $119,070

- 13.3% growth in Bay Area life science jobs (2014-2017)

- Companies include – Genentech, BioMarin, Novartis, Bayer, Gilead Sciences

- Lab Space (in square feet): 26.0m

- NIH Funding 2018/19: $1.41b

- Venture Capital Funding 2018/19: $6.05b

- Patents Awarded (total since 1976): 11,163

1. Boston / Cambridge, MA

- Jobs: 90,566

- Industry Overview:

- R&D cluster

- 35.2% growth in MA biopharma manufacturing jobs (2006-2019)

- Eighteen of the Top 20 biopharma companies have a presence

- Companies include – Sanofi, Biogen, Shire, Novartis, Boston Scientific

- Lab Space (in square feet): 26.8m

- NIH Funding 2018/19: $2.45b

- Venture Capital Funding 2018/19: $6.16b

- Patents Awarded (total since 1976): 7,565

Next Steps

Take our 16-Week Conversion Course into Pharma to retrain for an entry level job in the Pharma Industry OR fill in your knowledge or qualification gaps for our follow-on university programs.

Feel free to contact us to discuss your specific circumstances or to chat about what opportunities might be available to you within these industries.